The GENIUS Act: Ushering in a New Era for Stablecoins

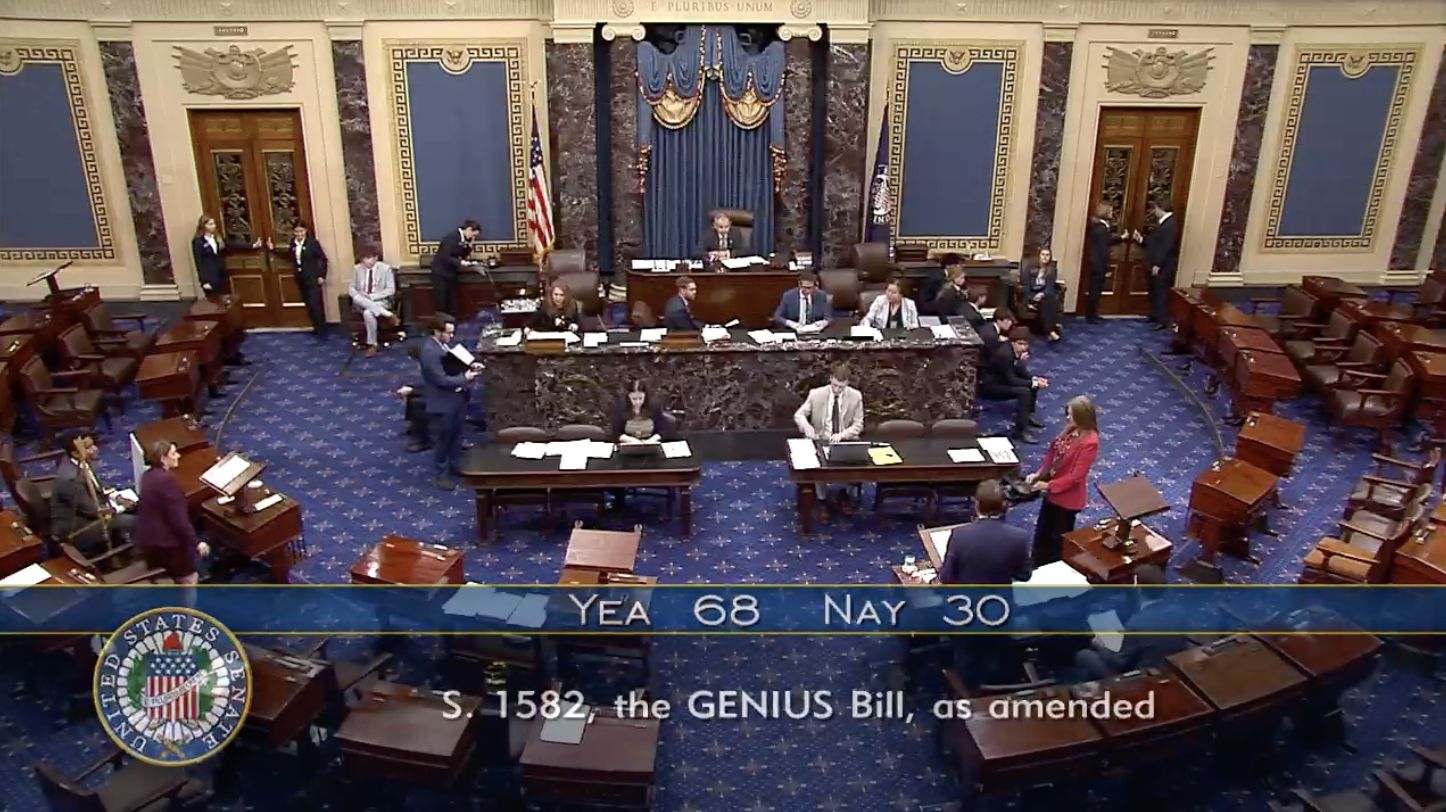

The cryptocurrency world just witnessed a pivotal moment. On Thursday, July 17, 2025, the U.S. House of Representatives officially passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS Act). This landmark stablecoin bill now moves to the President’s desk. Its passage marks a new era for digital assets. For Cryptopia.news readers, understanding this legislation is vital. It will reshape how we interact with stablecoins.

Understanding Stablecoins in a Changing Landscape

Before diving into the GENIUS Act, let’s quickly review stablecoins. They are a unique class of cryptocurrency. Their value is typically pegged to a stable asset, like the U.S. Dollar. This means one stablecoin generally equals one U.S. Dollar. They offer a crucial bridge between traditional finance and crypto’s volatility.

Traditionally, stablecoins have maintained their peg through various methods:

- Fiat-Backed: Companies hold traditional currency reserves (e.g., USD) in bank accounts. Examples include Tether (USDT) and USD Coin (USDC). Transparency about these reserves is key.

- Crypto-Backed: Other cryptocurrencies act as collateral, often overcollateralized to manage price swings. Dai (DAI) is a prime example.

- Algorithmic: These rely on code and market incentives to maintain their peg. They carry higher risks and have faced significant challenges.

The GENIUS Act primarily targets fiat-backed stablecoins. It aims to formalize their operation and build trust.

The GENIUS Act: Key Provisions and What They Mean

The GENIUS Act introduces a comprehensive federal framework. It provides clear rules for issuing and overseeing payment stablecoins in the U.S.

- 1:1 Backing Mandate: This is a core tenet. The bill requires stablecoins to be fully backed 1:1 by highly liquid assets. These include U.S. dollars or short-term U.S. Treasury bills. This provision significantly boosts confidence in their stability.

- Transparency and Audits: Issuers must provide regular public disclosures of their reserve composition. For larger issuers, annual independent audits are now mandatory. This addresses long-standing concerns about transparency.

- Issuer Eligibility: The Act restricts who can issue stablecoins. Only federally regulated banks and qualified nonbank entities can. State-regulated issuers can also participate under specific conditions. This creates a regulated perimeter around issuance.

- Consumer Protection: The legislation includes strong consumer protection measures. It prohibits misleading claims, such as implying federal insurance. It aims to safeguard users against fraudulent practices.

- Regulatory Clarity: The GENIUS Act explicitly defines payment stablecoins as non-securities. It positions them as payment instruments. This avoids previous jurisdictional ambiguities. It streamlines oversight between regulatory bodies.

- No Yield: A notable provision prohibits stablecoin issuers from paying yield or interest solely for holding the stablecoin. This distinguishes stablecoins as payment tools, not investment vehicles.

This legislation brings much-needed regulatory certainty. It defines “payment stablecoin.” It outlines who can issue them and how they maintain reserves.

Impact and Implications: What’s Next for GENIUS Act Stablecoins?

The passage of the GENIUS Act carries profound implications for the cryptocurrency landscape:

- Increased Legitimacy: A federal framework enhances the legitimacy of stablecoins. This will likely encourage broader adoption among traditional financial institutions and corporations.

- Market Growth Potential: Analysts predict significant growth. Some estimates suggest the stablecoin market could swell sevenfold by 2030. This demand could drive considerable purchases of U.S. Treasury bills.

- New Issuers: The clear regulatory pathway could trigger an influx of new issuers. Major financial institutions have reportedly explored stablecoin launches. They awaited this regulatory certainty. Banks and other regulated entities may now “rush into the market.” This offers consumers expanded choices.

- Enhanced Trust and Stability: Mandated full backing and regular audits aim to build greater public trust. This reduces risks of “de-pegging” events.

- Global Competitiveness: Senator Bill Hagerty, who introduced the bill, emphasized America’s need for digital finance leadership. Regulatory action ensures the U.S. remains competitive globally.

- Shifting Landscape: The Act also restricts publicly traded non-financial companies from issuing stablecoins. It also gives federal regulators more power over larger state-regulated issuers.

For Cryptopia.news users, this means a more mature and potentially safer stablecoin market. It could also lead to new integrations. Companies like Stripe, PayPal, and Walmart are already building infrastructure to support stablecoin integration.

Navigating the Future of Stablecoins

The GENIUS Act represents a watershed moment. It promises to unlock institutional confidence. It could drive mainstream adoption. However, users should remain informed:

- Choose Compliant Issuers: Favor stablecoins issued by entities adhering to the new federal standards.

- Understand Terms: Read disclosures. Know how your chosen stablecoin maintains its peg and its associated risks.

- Stay Updated: The implementation of the Act will involve further rulemaking. Stay informed through reliable sources like Cryptopia.news.

Ultimately, the GENIUS Act positions stablecoins for unprecedented growth and integration into the global financial system. It transforms them into a more robust and regulated digital dollar, paving the way for their widespread use in payments and beyond.

Post Comment