Could the World Function Without Banks? The Blockchain Future

Imagine a world where your financial interactions bypass traditional banks entirely. No branches, no lengthy approval processes, no intermediaries holding your funds. This isn’t just a futuristic fantasy. It’s the radical vision of a financial system built entirely on blockchain. The traditional banking system has been foundational for centuries. However, blockchain technology and cryptocurrencies now prompt a big question: is a world without banks blockchain truly possible? What would it look like?

The Vision of a Decentralized Future via Blockchain

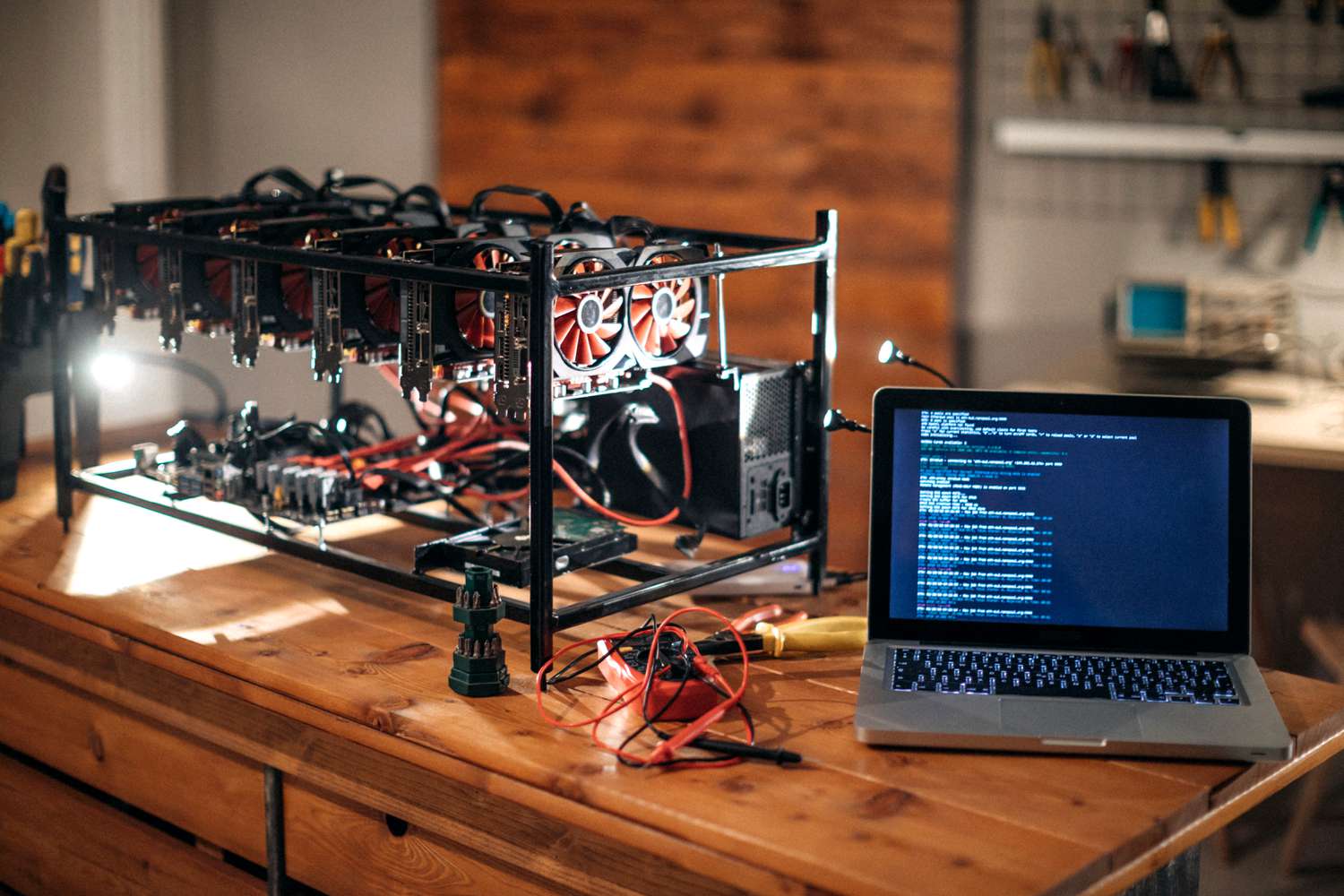

A fully blockchain financial system envisions decentralized finance (DeFi) taking over all banking functions. This means peer-to-peer transactions. Lending, borrowing, insurance, and complex investments all happen directly on public blockchains. Code, via smart contracts, governs these actions, not institutions.

- Financial Inclusion: Billions worldwide are unbanked or underbanked. A fully blockchain system could offer financial services to anyone with internet access. It bypasses geographical barriers and traditional credit checks.

- Reduced Costs & Speed: Transactions could be significantly cheaper and faster. Intermediaries like correspondent banks would be gone. Cross-border payments, for instance, might settle in minutes, not days, with minimal fees.

- Transparency & Immutability: Every transaction records on a public, immutable ledger. This increases transparency. It makes fraud and corruption far more difficult.

- Greater Control: Individuals directly control their assets using cryptographic keys. This reduces reliance on third parties to hold or manage their money.

- Programmable Money: Smart contracts allow “programmable money.” Funds release automatically when pre-defined conditions are met. This could automate everything from payroll to complex financial agreements.

This vision promises a more efficient, accessible, and transparent financial landscape. A world without banks blockchain aims for these benefits.

Significant Hurdles to a Bank-Free World

The benefits are compelling. Yet, transitioning to a fully blockchain system without banks faces immense challenges. These might even be insurmountable in the near to medium term.

- Regulation and Governance: Who sets rules in a decentralized system? How do we resolve disputes? Without central authorities, establishing consumer protection, anti-money laundering (AML), and know-your-customer (KYC) standards becomes incredibly complex. Illicit activities could easily proliferate without clear oversight.

- Scalability: Current major public blockchains, like Bitcoin and Ethereum, struggle with transaction volume. They cannot handle even a single large bank’s volume, let alone a global financial system. Scaling solutions emerge, but none have proven capable of handling global demand yet.

- Security and Error Reversibility: Blockchain is secure. However, user errors (e.g., sending funds to the wrong address) are irreversible. In a bank-less world, no customer service or central authority can claw back funds. Also, smart contract bugs can lead to massive financial losses. No recourse exists.

- Price Volatility: Most cryptocurrencies are highly volatile. This makes them unsuitable for everyday transactions or as a stable store of value. A reliable financial system needs stability. While stablecoins exist, centralized entities often back them. This reintroduces an element of traditional trust.

- Infrastructure and Accessibility: Internet access grows, but reliable access and the technical literacy needed for complex blockchain interfaces are not universal. Bridging the digital divide would be critical.

- Interoperability: The blockchain ecosystem is fragmented. Different blockchains do not easily communicate. This creates silos that hinder a seamless global financial flow.

- Systemic Risk: In a fully interconnected, decentralized system, a major bug or attack on a foundational protocol could have cascading, catastrophic effects. No central entity would step in and stabilize the market.

- Identity and Credit: How would we assess creditworthiness without traditional credit bureaus? Decentralized identity solutions are being explored, but they are nascent.

A Hybrid Future: Evolution, Not Revolution?

These challenges are immense. A complete overhaul, replacing the traditional banking system with pure blockchain, seems unlikely soon. Instead, a hybrid path is most probable. Banks already integrate blockchain for specific uses. They explore CBDCs and build digital asset capabilities.

Banks may evolve into “digital asset service providers.” They would provide regulatory compliance, customer support, and risk management that pure DeFi currently lacks. Blockchain technology will undoubtedly reshape finance. It will make it more efficient, transparent, and accessible. However, the human element of trust, regulation, and recourse that traditional banks offer will likely remain. Their role will transform, but they will ensure stability and confidence in the financial system. The future of money is digital and increasingly decentralized. But banks may well adapt to remain central players in this new paradigm. A true world without banks blockchain remains a distant goal.

Post Comment